Getting Ready For The Holiday Season

The holiday season is fast approaching - and with it comes Black Friday, Cyber Monday and the big C Word... Christmas. Despite the pressures of economic uncertainty, it's going to be a busier year than ever before, so is your brand ready?

What we saw in Q4 2022...

Global Consumer Spend across Q4 - a 3.5% increase from 2021.

Global Spend across Thanksgiving & Cyber Week - a 4% increase from 2021

Average Sector Specific Cost Per Click (CPC) in Q4 2022

Based on Incubeta Client Data, in Q4 2022 we saw a number of fluctuations in CPCs across each sector - ranging from £1.06 for the 'Food & Drink' industry, and £0.1 for the 'Travel' sector.

Breaking it down month-on-month, we saw notable changes across 'Health & Beauty' with a decline throughout October, picking up at the tail end of November rising to £0.99 at the start of December. 'Food & Drink' gradually increased across Q4 peaking mid-December, and 'House & Garden' fluctuated consistently throughout Q4 with highs of £1.2 in late-October and lows of £0.36 in mid-December. Overall 'Fashion & Retail' had the highest number of paid clicks in Q4 - totalling over 69 Million.

Out of all sectors, 'Travel' had the lowest CPC, closely followed by 'Software' at £0.22 and 'Entertainment' at £0.23.

Platform Spotlight

What we saw across Google...

We saw search interest for 'christmas' start earlier in 2022 than previous years, with spikes in late-August, and a gradual increase starting mid-September. Related queries included 'christmas tree', 'christmas 2022' and 'christmas lights' with traffic from the UK, Ireland, US, Australia and Trinidad & Tobago as the top regions. We can expect to see this pattern repeated across 2023, with search trends for 'christmas' starting even earlier than in previous years.

Platform Spotlight

What we saw across Amazon...

We saw a 195% increase in Christmas related search volumes comparing the first week of October to the last week before Christmas with the week before Christmas seeing 41% more search volumes than Black Friday Week. General search interest for 'christmas gifts' spiked considerably earlier as well, with over 230K searches pre October. We can expect to see this pattern replicated across 2023, with Amazon's Prime Early Access Sale (11th-12th October) instigating early Christmas shopping.

Platform Spotlight

What we saw across TikTok...

Across the course of Q4 we saw TikTok generate a revenue of approximately $528 Million - with over 206 Million users downloading the app from October through to December. We can expect to see this growth echoed across the entirety of 2023 - as January to March 2023 only saw a 1% decrease in TikTok revenue in comparison to Q4 2022 ($497.69 Million).

What can we expect in Q4 2023?

Estimated Advertising Spend across Q4 - a 5.6% increase on Q3.

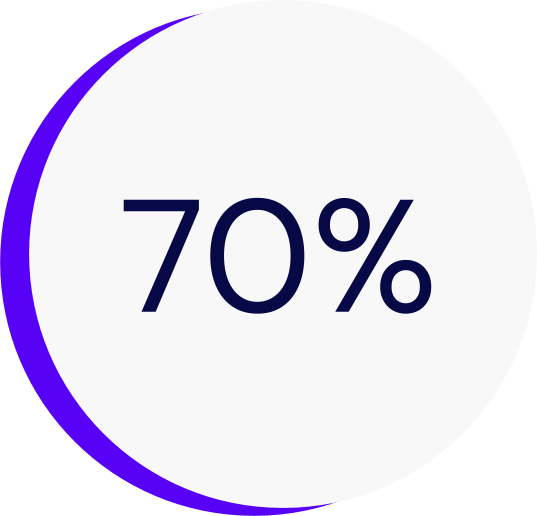

Of consumers expect to spend $100+ on Christmas this year - Numerator

Thinking with a Consumer-First Mindset is Key...

Rises in privacy regulations and current economical pressures means implementing a consumer-first approach will be of the upmost importance during this holiday season. You should be putting your customers at the centre of all that you do - offering personalization without sacrificing privacy - building relationships on 'their' terms.

To strike the right balance between security and personalization you will need to incorporate strong, consent-based frameworks for the data you collect and build in a value exchange to preserve the trust of your consumers.

Be mindful of financial realities and the diversity of your audience. While you want to encourage sales and drive awareness, its important to display understanding and sympathy for those with limited, if any disposable income, and the impact that the festive season may be having.

Getting Creative...

In today’s ever changing landscape, harnessing the power of data-driven creative has become a cornerstone for brands aiming to stand out, especially during key calendar events – such as Christmas.

Competition is at an all-time-high, and as consumers grapple with the ever changing cost of living, making an impact within your creative ads has never been more important.

The key is to; Plan Ahead, Get Personal, Use Data, Be Inclusive, Engage your Audience, Read the Room, Keep it Authentic, and Be Consistent. Check out our article to learn more; How to Nail your Creatives this Christmas.

Early Bird Catches the Worm...

Consumers will start spending earlier than in previous years - with festive related search trends starting as early as July. As a result, brands need to mirror consumer behaviour and start 'revving' their festive engines - being present and capitalizing on audience needs. All while demonstrating a strong commitment to transparency, trustworthiness and helpfulness.

Rising CPCs

As the competition heats up, we'll begin to see a rise in CPCs - with numerous brands competing for the same search terms. And whilst competition isn't necessarily a bad thing, with the stakes being so high for many brands alongside the average cost-per-click, it's time for marketers to pivot their strategy and adopt alternative approaches to growth. Start considering branding and social commerce efforts...

Leveraging the 'Lipstick Effect'

When financial times are tough, consumers will still tend to buy small luxury items (such as lipstick), even as larger ticket purchases have to be pushed back. Making them feel good without breaking the bank... Leveraging this need for 'indulgence' can help you tap into a new purchasing stream. There can also be a good cross-sell opportunity here for last minute add ons so maximize any opportunities during the checkout process to capitalize on impulse consumer decisions.

Bargain Hunters

With the cost of living crisis putting pressure on budgets, consumers are becoming less brand loyal and prolonging their purchasing decisions to find the best deals and value for money. 52.9% of consumers are willing to switch brands if they can save money - with over 60% actively looking for the lowest product price when shopping. With this in mind, the holiday season will be saturated with bargain hunters, and brands that have a strong discount strategy in mind will come out on top.

Getting Personal

As always, competition will be hot this holiday season, with advertisers fighting for customer attention. Standing out has never been more important so consider getting personal with your marketing - capturing the attention of shoppers with intelligent and personalized messaging. The modern consumer expects to be approached by companies with a personal touch. At the same time, they don’t want to feel that they’re being tracked and followed everywhere - so keep it privacy compliant!

Platform Spotlight

What we'll see across Google...

Mirroring 2022, we can expect to see search trends for holiday season related queries starting much earlier this year. We've already seen a gradual pick across Google for the search term 'christmas' - spiking at the start of August in comparison to the months prior. With worldwide inflation and budget constraints we expect consumers to be spreading their costs - investing in Christmas related products earlier in the year to avoid mass-expenditure across Q4.

Platform Spotlight

What we'll see across Amazon...

With an additional Prime Day in October shaking things up we'll either see a dilution of sales OR another day of larger than average sales which Sellers will have to invest in. Traffic will likely even out across Q4, however we'll continue to see peaks across November and early December. Spends will remain high but the environment from an Ads perspective will be challenging with the introduction of the new Prime Day. ‘Value’ is going to be the key to winning customers.

Platform Spotlight

What we'll see across TikTok...

With TikTok officially entering the ecommerce space - monetizing the #TikTokMadeMeBuyIt phenomenon and selling goods directly to US consumers, we'll likely see a rise in interest and profitability from the platform across Q4. Gross merchandise value on TikTok Shop is expected to hit $20 billion this year - a 300% increase on last year. That being said, TikTok have experienced certain teething issues, and while it's a must in social commerce and advertising strategies, TikTok is more of a 'nice-to-have' for merchants at this current moment in time.

Useful Assets

The Role of Emotions in Online Shopping

Opportunity in Times of Change

For many brands, 2023 promises to be an uncertain and unpredictable time. Financial instability is at an all-time high, third-party cookies are fast deprecating, and consumers are demanding more from brands than ever before. Marketers are having to be more sustainable, more relatable, and more accessible – making it increasingly harder to control what can only be described as ‘chaos’.

How to Nail your Creatives this Christmas

In today’s ever changing landscape, harnessing the power of data-driven creative has become a cornerstone for brands aiming to stand out, especially during key calendar events – such as Christmas.

A World Without Cookies

As the era of third-party cookies draws to a close, filling the gap in your digital marketing strategy should be the most important task on your to-do list. The shift away from cookies (forgive us for sounding like a stuck record) will have a significant impact across the entire marketing landscape, and most existing data strategies are not strong enough to withstand the upcoming changes – however hard you might manifest…

Amazon & AI: Transforming Retail

As one of the largest online marketplaces in the world, Amazon has a massive influence on the way millions of people shop. Their popularity, product diversity, and offered convenience have made them a go-to destination for consumers all over the globe. Meaning, if they adopt AI, they’ll play a notable role in the way millions of consumers worldwide adopt AI.

Retail Resilience

Ready to swerve today’s barriers to growth and harness the opportunities for retail success?

Amid stormy seas, not everyone is in the same boat, and your brand’s vessel is tipped for success if you embrace a connected strategy that properly recognises consumers’ real and varied experiences. So let Incubeta help you overcome economic challenges and drive growth.